Age as well as vehicle insurance As a general guideline, you can anticipate to pay one of the most follow this link for your vehicle insurance coverage when you're under 25. Once individuals are over 25, they tend to locate that the cost of their automobile insurance coverage begins to fall - business insurance. The rate usually decreases progressively between the ages of 25 and 60 (low-cost auto insurance).

Insurance providers do not understand at this factor how likely it is that such a motorist will make an insurance claim, so they bill even more to see to it they are covered. Risk Car insurance coverage premiums are calculated by taking risk right into factor to consider. risks. Statistically, younger motorists make more claims, so they are higher threat.

vehicle vans credit cheaper auto insurance

vehicle vans credit cheaper auto insurance

Can I decrease the expense? While there's no rejecting that motorists matured in between 17 and also 25 pay the most for their automobile insurance, there are some points you can do to ensure you pay less than you require to (affordable car insurance). Telematics or Black Box Black Box or Telematics vehicle insurance coverage specifically interest young drivers.

auto vehicle credit score auto

auto vehicle credit score auto

If you do obtain a better quote, you could ask your current insurance firm to match it (cheaper car).

Threat assessors have established that those 25 or older are more likely to be much more liable and also that their risk of at-fault accidents has actually reduced - vehicle insurance. So the base price for your cars and truck insurance coverage changes at this age because you have actually matured into a better motorist class; it's not a cars and truck insurance policy discount rate for turning 25 as some believe.

Here's When Your Car Insurance Rates Start To Go Down Can Be Fun For Anyone

Insurance companies score systems as well as aspects can vary, along with the state regulations controling them, so exactly how much your automobile insurance policy rates will certainly transform will certainly vary. affordable. We have actually seen rates lowered as high as 20 percent when a vehicle driver reaches the age of 25, if that person has actually kept a clean driving record as well as had no crashes - affordable auto insurance.

credit score car insured insurers cheapest auto insurance

credit score car insured insurers cheapest auto insurance

your prices might stay the exact same, or increase, because of these factors. If you don't see a recognizable decrease in your rates after you've turned 25, ask your vehicle insurance coverage carrier why. It might be that you're with a firm, such as Esurance, that rather of offering one large price reduction at age 25 they constantly lowers prices every plan term as the young drivers they guarantee age as well as have actually shown to be excellent drivers without any mishap claims or traffic offenses. cheap.

So, if you're thinking concerning buying that dream car you've always desired, talk with your insurance coverage firm regarding exactly how your rates will certainly be impacted. Bear in mind high-end autos aren't the only ones that go to a risky of burglary. Thieves likewise target automobiles with high-demand components. 5. Adding a vehicle driver to your plan, All the elements above as they relate to an extra vehicle driver on your policy can ultimately influence your rate.

Worried about insuring your teen vehicle driver? If they have a GPA of a B or far better, they may receive our Good Pupil Discount Rate. Start your quote today to read more. dui.

car insurance cheaper car cheapest auto insurance insurance

car insurance cheaper car cheapest auto insurance insurance

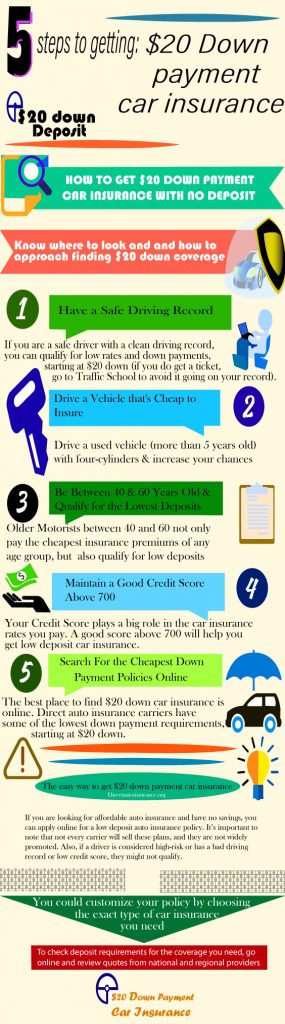

Automobile insurance coverage is required to protect you monetarily when behind the wheel. Whether you just have standard responsibility insurance coverage or you have full car insurance coverage, it is essential to guarantee that you're obtaining the most effective offer possible. Wondering how to decrease automobile insurance policy!.?.!? Below are 15 strategies for reducing auto insurance coverage prices.

How Age And Gender Affect Car Insurance Rates - Forbes Things To Know Before You Buy

Reduced auto insurance coverage rates may additionally be offered if you have other insurance coverage with the exact same company. Keeping a safe driving document is essential to obtaining reduced auto insurance policy prices. Just How Much Does Car Insurance Cost? Auto insurance prices are various for every motorist, relying on the state they reside in, their option of insurance firm and also the sort of insurance coverage they have.

The numbers are relatively close with each other, recommending that as you allocate a brand-new car acquisition you might require to consist of $100 approximately monthly for car insurance coverage - car. Note While some things that affect automobile insurance policy rates-- such as your driving history-- are within your control others, expenses might also be affected by things like state regulations and also state crash rates.

auto cheaper car insurance auto prices

auto cheaper car insurance auto prices

When you know just how much is cars and truck insurance coverage for you, you can put some or every one of these methods t work. affordable car insurance. 1. Make Use Of Multi-Car Discounts If you obtain a quote from a car insurance provider to guarantee a single lorry, you could wind up with a higher quote per lorry than if you made inquiries about guaranteeing numerous vehicle drivers or cars with that said business. cheaper car insurance.

Nevertheless, if your kid's grades are a B standard or over or if they rank in the top 20% of the class, you may be able to obtain a good pupil discount rate on the coverage, which typically lasts until your child transforms 25 - automobile. These discounts can vary from as little as 1% to as high as 39%, so be certain to reveal evidence to your insurance policy agent that your teen is a good pupil.

Allstate, for instance, offers a 10% car insurance policy discount and a 25% home owners insurance policy price cut when you bundle them with each other, so inspect to see if such discount rates are readily available and also relevant. Pay Focus on the Road In other words, be a risk-free driver.

The Main Principles Of Do You Get A Car Insurance Discount When You Turn 25?

Travelers provides secure vehicle driver discount rates of in between 10% and also 23%, depending on your driving record. For those unaware, factors are commonly analyzed to a chauffeur for relocating offenses, and a lot more factors can lead to higher insurance coverage premiums (all else being equal).

Make certain to ask your agent/insurance firm concerning this price cut prior to you enroll in a class - vehicle insurance. Besides, it is very important that the effort being expended as well as the price of the course translate into a big enough insurance cost savings. It's also important that the motorist sign up for an accredited training course.